-

Health Insurance

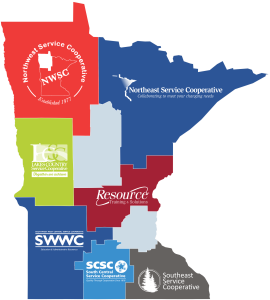

Northeast Service Cooperative & Minnesota Health Care Consortium

Your Service Cooperative group health insurance pool spreads risk and reduces cost while providing you the freedom to select the doctor and health plan of your choice. You will be the decision maker to see any doctor, clinic, or hospital for your care. This freedom gives you greater satisfaction about your healthcare, which leads to perceived and actual improvements in your well-being. And it works!

Features

- Statewide risk pool under Minnesota Healthcare Consortium (MHC)

- Rating methodology to provide stability

- Lower pooling limits for catastrophic claims

- Blending your claims with regional expectations to stabilize smaller groups

- Your choice of level of assistance for mandatory bids

- New networks and plan design options

- A selection of consumer tools and programs customizable to each member

- Statewide Small Group Insurance Pool for groups with 50 or less contracts.

- Statewide Large Group Insurance Pool for groups with more than 50 contracts

Advantages

- Regional pool discretion and reserves

- Group control of benefit design

- Dedicated Service Cooperative and Medica teams

- Discounted access to medical savings and spending accounts with WEX

- Customized wellness programs with grant funding available

- Education and resources available on best practices & mandates

CLICK HERE to learn how your group can obtain a quote from MHC.

-

Dental Insurance

Northeast Service Cooperative works with Delta Dental of Minnesota to meet the needs of our participating members with a designed voluntary dental program. The combined purchasing power of your organization with other member groups results in strong savings and the flexibility to provide employees choices for dental plans. Employees are free to see any dentist and there are additional savings when visiting a network dentist. Being the largest network in the state, chances are your dentist is already included.

Delta Dental of Minnesota has designed plans easy to use, and providing maximum savings and easy access to Minnesota’s largest dentist networks. This is backed with an unparalleled commitment to services. Together, the goal is to help to maintain happy, healthy smiles all year long.

Dental Offerings:

For more information contact:

- Jeanette Mellesmoen | jmellesmoen@nescmn.net | 218-748-7617

- Lauren Sterk | lsterk@nescmn.net | 218-748-7622

-

Life Insurance Plans

Northeast Service Cooperative membership gives you access to a variety of life insurance plans. We believe life insurance should provide the security needed to assure loved ones are financially protected in the event of death and should be flexible enough to meet immediate, as well as future, needs.

National Insurance Services delivers custom-crafted, flexible, price-conscious plans for you and your employees and has plan designs suited to public sector issues, even negotiated contracts.

Minnesota Service Cooperatives Group Term Life Insurance:

Flexible Plan Features

- Customized retiree coverage

- Optional age-reduction schedule

- Lifetime Waiver of Premium Payments

- Eligibility below 20 hours per week

Optional Plan Enhancements

- Accidental Death & Dismemberment Insurance

- Accelerated Life Benefit

- Supplemental employee-paid plans

- Voluntary employee, spouse and dependent coverage

National Insurance Services Contact:

Natalie Owen

Account Representative

Phone: 1-800-627-3660

Email: nowen@NISBenefits.com

https://www.nisbenefits.com/ -

VSP Vision

NESC, along with the Minnesota Healthcare Consortium, partners with VSP to offer our members vision coverage at a reduced cost to members. This program is a voluntary, member paid insurance. Click on the links below for additional information.

Plan Offerings:

- Vision Plan – Materials Only

- Vision Plan – Exam and Materials | Exam and Materials

For more information contact:

Jeanette Mellesmoen | jmellesmoen@nescmn.net | 218-748-7617

Suzi Ruper | sruper@nescmn.net | 218-748-7604 -

Long-Term Care

It is never too early to plan for long-term care options for your family. Planning ahead by purchasing long-term care insurance can help protect your family savings from costs that are not covered by traditional health insurance or government programs.

We are here to assist members and help ease the stress of long-term planning. We can provide information to make these decisions easier and assist with planning for the future.

- Long-term care insurance can help members to:

- Receive care in the comfort of home.

- Protect savings, personal assets and your home.

- Make choices about whom and where you want to receive care.

For more information on long-term care, contact Suzi Ruper at sruper@nescmn.net

-

Insurance Pool Health and Wellness Programs

Northeast Service Cooperative believes in prevention-oriented health promotion programs for all its member organizations. Employers are increasingly recognizing the importance of healthy employees. Member of our health insurance pool have access to health and well being programs that focus on making healthy choices when it comes to their health journey. Medica’s health and wellness programs listed below are available to our insurance pool members.

Medica Health and Wellness Programs

Virtual Care

- Amwell (Doctors are available 24 hours a day, 365 days a year)

- Virtuwell (Certified Nurse Practitioners 24/7 online clinic)

Additional Medica Resources

Register for your Medica Portal – Click the below link

If you have questions about your organization’s eligibility, contact Jeanette or Suzi for additional information.

- Jeanette Mellesmoen | jmellesmoen@nescmn.net

- Suzi Ruper | sruper@nescmn.net

Wellness Newsletters for Insurance Pool Members

-

Medical Savings Accounts

Voluntary Beneficiary Association (VEBA)

The VEBA Plans feature a Consumer Directed Health Plan (CDHP) that works alongside a tax-exempt personal health account. This plan is offered through participating Minnesota Service Cooperatives. It gives you a way to reduce your health care costs while allowing employees more control and choice in their health care usage. Simply put, we’ve created a health plan that works alongside a tax-exempt VEBA personal health account. The health plans feature a higher deductible, so premiums can be lower than traditional plan coverage. The interest-earning account is employer-funded and can be used to pay for qualified medical expenses until the deductible has been satisfied. Since the funds in the account are not taxed, your health care dollar goes farther. Also, the funds in the account will carry over from year to year.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged medical savings account you can contribute to and draw money from for certain medical expenses tax-free. HSAs can be used for out-of-pocket medical, dental, and vision. HSAs can’t be used to pay health insurance premiums.

Consumer Directed Health Plan (CDHP)

CDHPs come in various forms, but most commonly a CDHP means offering a high-deductible health plan paired with spending account for out-of-pocket costs such as a Health Savings Account (HSA) or Integrated Health Reimbursement Arrangement (HRA) also referred to as a VEBA.

Minimum Value Plan (MVP)

A standard of minimum coverage that applies to job-based health plans. If your employer’s plan meets this standard and is considered “affordable,” you won’t be eligible for a premium tax credit if you buy a Marketplace insurance plan instead. A health plan meets the minimum value standard if both of these apply: It’s designed to pay at least 60% of the total cost of medical services for a standard population. Its benefits include substantial coverage of physician and inpatient hospital services.

For more information on your Medical Savings Accounts contact:

Marlo Peterson, Consumer Directed Business Consultant, Northeast Service Cooperative

mpeterson@nescmn.netPurchasing your group health insurance and selecting your health savings accounts such as VEBA, FSA and HSA through your Service Cooperative can save you and your organization money. Just like buying your groceries in bulk at a wholesale club, the Service Cooperative negotiates health care costs collectively and can secure lower costs and deliver greater value. And here’s the best part: the savings and value are passed on to you.

Medical Savings Account Helpful Links

-

Worksite Wellness

Grant Rationale:

Since “health” is an implicit goal in health care delivery, health promotion activities are important to our members, employer groups and the regional insurance pools. Furthermore:

- Discretionary work site dollars are increasingly scarce

- New plan designs encourage informed, personal health management

- Grant-based activities complement other health and wellness components already imbedded in many health plans such as the fitness discount, Healthy Start, Chronic Condition and Disease Management.

- Members have requested resources and support in the areas of health and wellness

- Worksites offer opportunities for research-based results (modeling, social support)

Suggested Activities:

- Brown bag lunch series with health/wellness speaker/presenter

- Fitness equipment for checkout such as canoes, kayaks, etc

- Prevention clinics (e.g. flu shots, bp monitoring) when not offered through the plan

- Incentives (prizes, gift cards) for a physical/wellness challenges/contests

- Monthly/weekly staff “salad bar” luncheon and/or school cafeteria “salad bar” luncheon

- Healthy snacks (fruit, veggies)

- Exercise/wellness/health promotion media (DVDs, books) to give away or lend

- Health/wellness newsletters/publications…device-based applications

- Special health/wellness events

- Committee liaison or communication efforts (w/local resources, regional centers, Medica)

- CPR/First Aid training for staff

- Exercise equipment (treadmill, elliptical, stationary bike)

- Pedometers, hand sanitizers, first aid kits, blood pressure cuffs, other monitors

- Exercise mats, jump ropes, exercise classes

- Bicycle racks for commuters, incentives for non-motorized commuters

- Seed money for other and matching grants/activities

- Staff garden planting boxes/seeds/vegetable plants etc.

- Membership to whole foods cooperative

- Other locally-based and/or cooperative initiatives

Click to learn about more Wellness Product Ideas available through Cooperative Purchasing Connection and Express Marketplace.

Download the ISD Wellness Grant Utilization Form to get started on your wellness journey.

Click here for Wellness Tips and Recipes.

-

Employee Assistance Program

Northeast Service Cooperative offers an Employee Assistance Program (EAP) for its employees and members. Having an assistance program available is an important benefit as we care about the well-being of our members.

NuVantage is a safe, comfortable and confidential resource for employees and their families when they need guidance or advice with the challenges and problems of daily living. The services are designed to help employees assess and resolve issues affecting their personal and/or work life including:

- Relationship conflicts

- Chemical dependency concerns

- Parenting challenges

- Work-related problems

- Career concerns

- Financial and legal issues

- Dependent care challenges

MANAGER SUPPORT

NuVantage Employee Resource helps supervisors and managers face challenges with individual employees and work groups including job performance, attitude, employee conflicts, communication and other issues that influence the effectiveness of the organization. Services to employers include the following:

- Employee work performance issues

- Harassment problems

- Power struggles among staff

- Stress and burnout

- Workplace conflicts

- Chemical abuse/dependency

NuVantage also provides comprehensive case management for employees who have been referred to the EAP as a result of a performance concern.

Visit the NuVantage Employee Resource Website for more information. Assistance is available 24 hours a day, seven days a week: 1-800-577-4727.

Download the NuAdvantage Employee Resource Information Guide to learn more.

-

Focus on Healthy Eating - NESC Recipe Bank

Eating healthy offers numerous benefits for both your physical and mental well-being:

- Improved Physical Health: A balanced diet provides essential nutrients that support bodily functions, including vitamins, minerals, and antioxidants. This can lead to better overall health, lower risk of chronic diseases like heart disease, diabetes, and certain cancers, and stronger immune function.

- Weight Management: Healthy eating can help maintain a healthy weight or aid in weight loss by promoting proper portion control and providing nutrient-dense foods that satisfy hunger and reduce cravings.

- Increased Energy Levels: Nutrient-rich foods provide sustained energy throughout the day, reducing fatigue and enhancing productivity and focus.

- Better Digestive Health: A diet high in fiber from fruits, vegetables, and whole grains supports digestive health, preventing constipation and reducing the risk of digestive disorders like diverticulosis and hemorrhoids.

- Stronger Bones and Teeth: Foods rich in calcium, vitamin D, and other nutrients support bone health and reduce the risk of osteoporosis and tooth decay.

- Improved Mood and Mental Health: Certain nutrients, such as omega-3 fatty acids found in fish and folate found in leafy greens, are linked to better mood regulation and lower risk of depression. Eating a balanced diet can also improve cognitive function and reduce the risk of age-related cognitive decline.

- Better Sleep: Healthy eating habits can promote better sleep quality, as certain foods and nutrients, such as complex carbohydrates and magnesium, can help regulate sleep patterns.

- Enhanced Longevity: Research suggests that a nutritious diet, combined with other healthy lifestyle habits like regular exercise and stress management, can contribute to a longer lifespan and improved quality of life in older age.

Overall, making healthy food choices is an investment in your long-term health and well-being, offering benefits that extend far beyond just physical health.

Staff

- Jeanette Mellesmoen – CFO & Director of Operations

- Suzi Ruper – Manager, Strategic Marketing & Business Development

- Lauren Sterk – Insurance Pool & Business Office Assistant

- Marlo Peterson – Consumer-Directed Business Consultant